Unlimited access,

closer to the

Korean economy

Bringing Korea’s key insights and market trends to global investors and business leaders. Unlock new opportunities through in-depth analysis and premium content.

50% Off to Celebrate Our New Membership Launch

Get unlimited access to

KED Global articles for only $10

Monthly Plan

$10/mo

$20

You can cancel anytime

Billed at $10 per month for your first year, then $20 per month thereafter

50% off

58% off

Annual Plan

Billed once at $100 for your first year, then $200 per year thereafter

$240

You can cancel anytime

$100/year

Subscribe now

After the promotional period ends, your subscription will renew at the regular rate.

For details, please refer to the Terms of Service.

Exclusive Member Benefits

Priority Access to in-depth insights on the Korean economy

Unlimited access to all premium content

Professional Analysis and investment insights available exclusively to members

Members-only newsletter

Stay informed with K-Deals, our exclusive newsletter featuring: Weekly updates on Korean corporate deals and investments

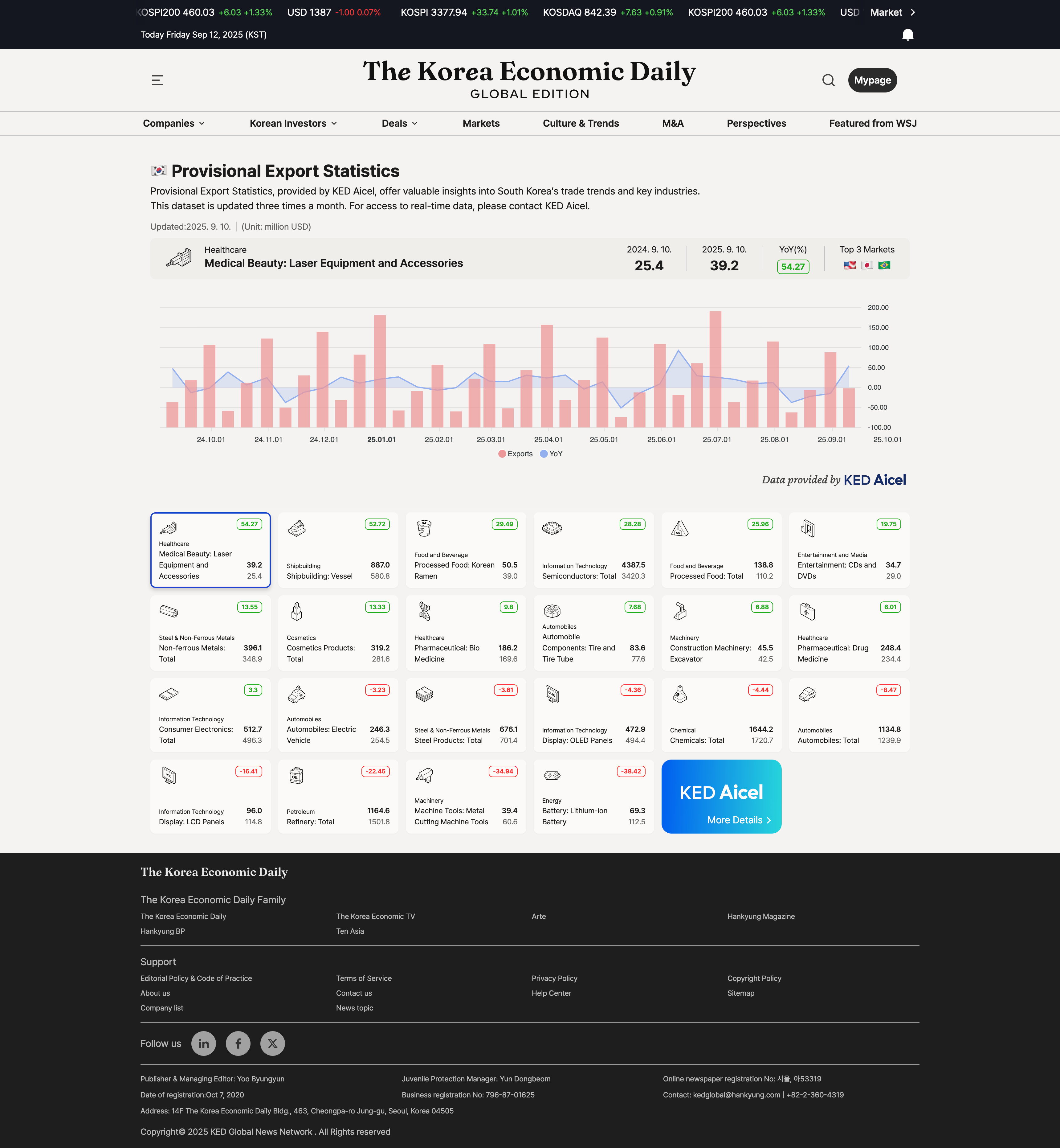

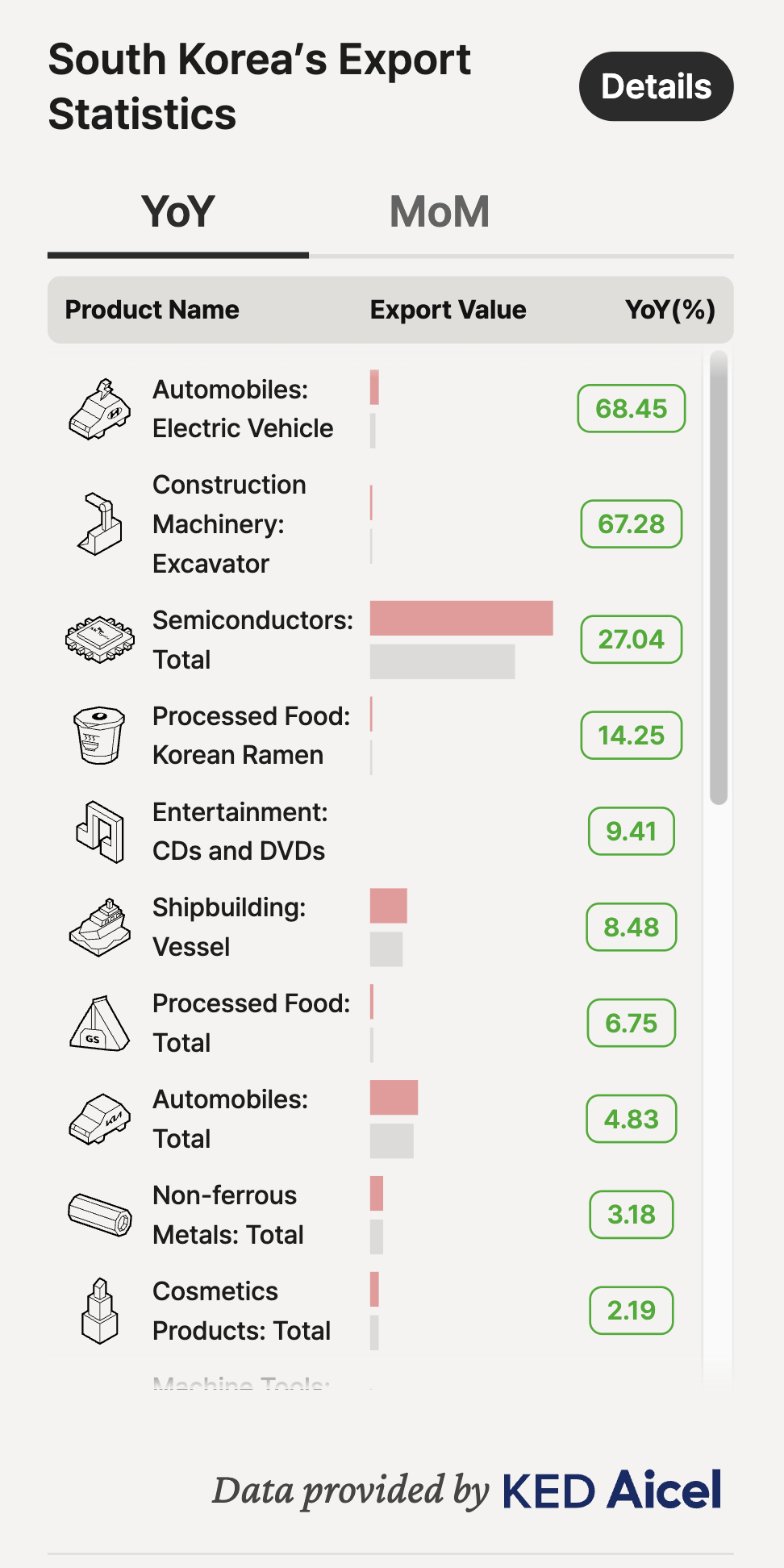

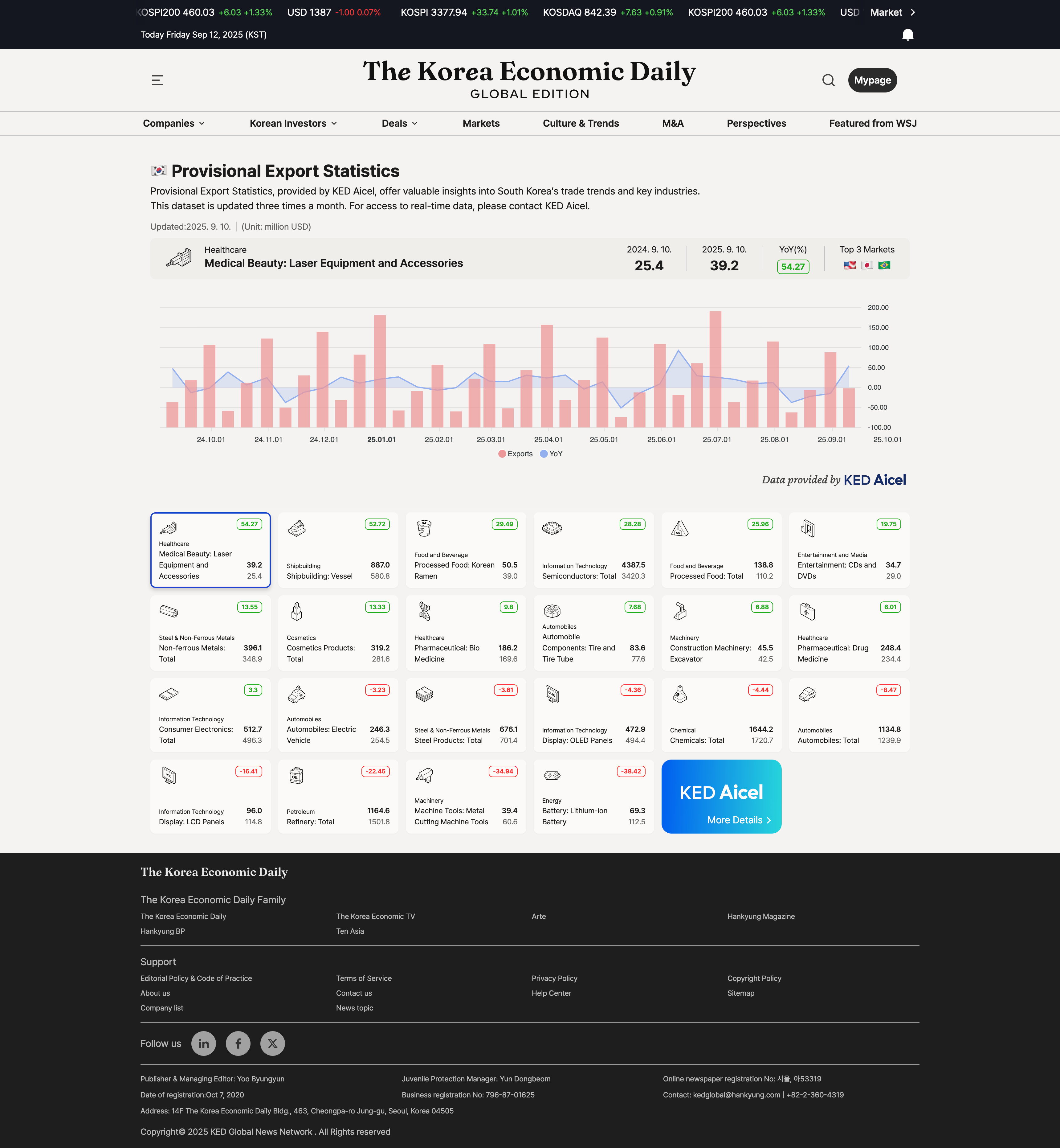

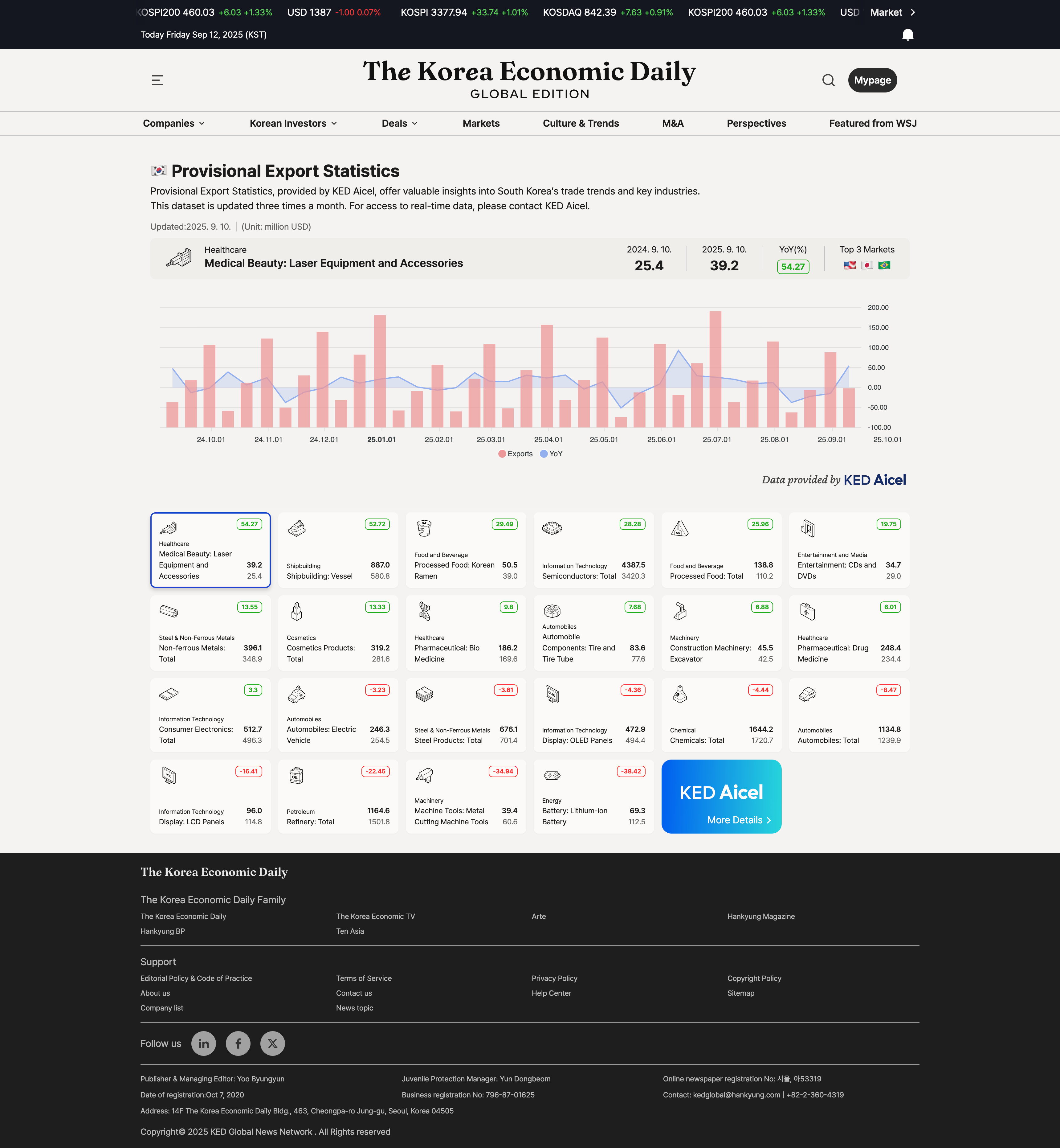

Korea’s Major Export Data

Gain valuable investment insights through trade and industry analysis.

Best Asset Managers Survey

Discover the latest results from our survey of top-performing asset managers, selected by Korean investors.

Discover Member-Only Content

Explore deeper insights with a wide range of premium content,

including exclusive data, in-depth analysis and expert investment commentary.

DDR5 spot prices

Forecasts for Samsung

Electronics’ operating profit

May 23

May 30

Jun 6

Jun 13

Jun 20

2023

0

0

20

5.4

40

5.6

60

5.8

80

6.0

2024

2025

2026

2027

(Source: Morgan Stanley)

(Source: DRAMeXchange)

*Estimates from 2025 to 2027

*DDR5 16G 4800/5600 products

(Unit: dollars)

(Unit: trillion won)

66

6.6

5.5

6.0

Data Speaks

We offer real-time, data-driven insights on Korean companies and industries using alternative data such as trade, consumption, customs figures and news analytics.

Each article provides differentiated, data-based perspectives on the Korean market.

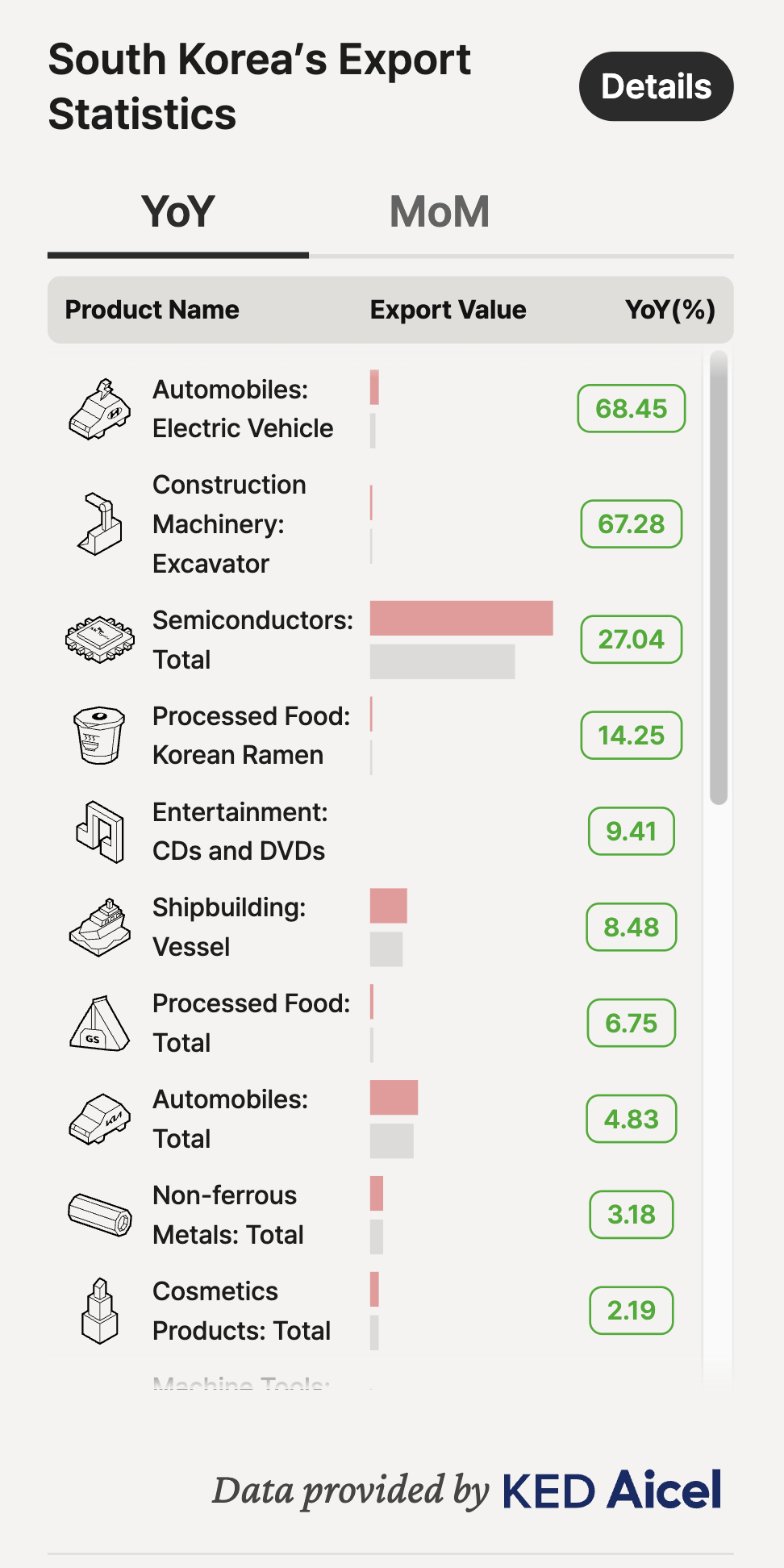

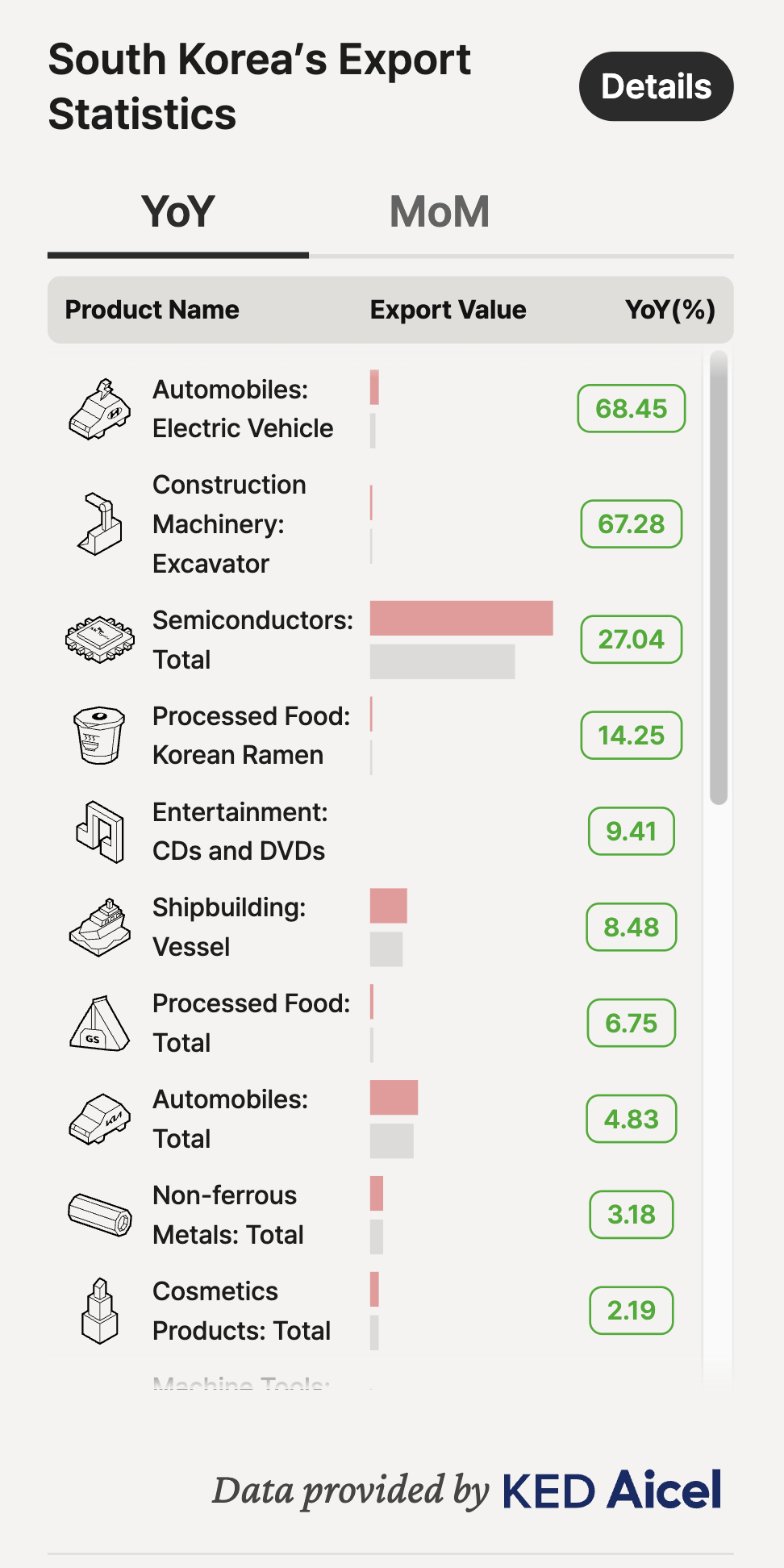

South Korea’s Export Statistics

Track Korea’s trade dynamics and key industries.

Use these insights to monitor sector trends, competitor activity, and apply them directly to your investment strategies and market outlooks.

October 15, 2025

$

-

Deals

Deals Spotlight News

SK Group will sell its entire 35% stake in Sinopec-SK Petrochemical, exiting the petrochemical sector after losses of over 1 trillion won since 2021 due to oversupply and weak demand.

The Wuhan-based plant, launched in 2013 with 3.3 trillion won, once generated 2 trillion won in cumulative profit but has seen profitability collapse as China rapidly expanded ethylene output.

The divestment aligns with SK’s shift to its “ABC strategy” of AI, batteries, and chips, with proceeds of about 819.3 billion won expected to fund AI data centers, semiconductor packaging, and energy systems.

SK Group’s decision highlights its shift from traditional industries to future growth engines, with attention now on how AI and semiconductor investments will pay off.

More to Read

Editor’s comment

- LG Chem to sell water filter business to Glenwood PE for $692 million

- Korea’s top cinema chains seek merger to counter box office slump

- LG Electronics breaks ground on $600 mn home appliance plant in India

SK Group to sell entire 35% stake in Chinese JV Sinopec-SK Petrochemical

Hello from Seoul!

Here’s what’s shaping the week.Samsung is doubling down on itself – powering about half of its upcoming Galaxy S26 phones with its own Exynos 2600 AP. After years of setbacks, it’s a bold play to bring its chip game back to the big league. Our coverage breaks down what’s fueling Samsung’s renewed confidence in chip design and foundry operations.

EDITOR’S NOTE

By Sookyung Seo

Hello, here are this week’s K-Deals updates.

K-Deals Newsletter

Receive weekly updates on major deals involving Korean companies and institutional investors

— such as M&As, investments, and asset sales—through our members-only newsletter.

About KED Global

The KED Global delivers trusted, high-impact journalism on the Korean economy and the Korean market for a global audience of economists, investors and business leaders.

Journalism of Global Standards

Editors from Reuters, Bloomberg and the Wall Street Journal bring you insight-driven reporting that goes beyond simple translation.

Private equity

Economy

Business & Politics

Korea-Focused Professional Content

Access curated, verified and premium economic and business intelligence – all in one place.

$

Spotlighting Korean Companies

We highlight the global growth and innovation of Korean companies, from advanced manufacturing to high technology.

Quick & Brief

Every Weekday

$

Korean Investors

Wednesdays

$

Newsletter for Busy Investors

Subscribe to Korean Investors and Quick & Brief for free and receive key updates on the Korean market every morning.

FAQ

How can I cancel my subscription?

What is the refund policy if I cancel immediately?

How can I contact KED Global Support?

Membership for Global Investors and Leaders

Join today and start exploring the Korean economy like never before.

Subscribe Now

The Korea Economic Daily Family

Support

Publisher & Managing Editor: Yoo Byungyun

Juvenile Protection Manager: Yun Dongbeom

Online newspaper registration No: 서울, 아53319

Date of registration: Oct 7, 2020

Business registration No: 796-87-01625

Contact: kedglobal@hankyung.com | +82-2-360-4319

Address: 14F The Korea Economic Daily Bldg., 463, Cheongpa-ro Jung-gu, Seoul, Korea 04505

Copyright© 2025 KED Global News Network . All Rights reserved

Unlimited access,

closer to the

Korean economy

Bringing Korea’s key insights and market trends to global investors and business leaders. Unlock new opportunities through in-depth analysis and premium content.

50% Off to Celebrate Our New Membership Launch

Get unlimited access to

KED Global articles for only $10

Monthly Plan

$10/mo

$20

You can cancel anytime

Billed at $10 per month for your first year, then $20 per month thereafter

50% off

58% off

Annual Plan

Billed once at $100 for your first year, then $200 per year thereafter

$240

$100/year

You can cancel anytime

Subscribe now

After the promotional period ends, your subscription will renew at the regular rate.

For details, please refer to the Terms of Service.

Exclusive Member Benefits

Gain priority access to important,

in-depth insights on the Korean economy

Unlimited access to all premium content

Professional Analysis and investment insights available exclusively to members

Members-only newsletter

Stay informed with K-Deals, our exclusive newsletter featuring:

Weekly updates on Korean corporate deals and investments

Korea’s Major Export Data

Gain valuable investment insights through trade and industry analysis.

Best Asset Managers Survey

Discover the latest results from our survey of top-performing asset managers, selected by Korean investors.

Discover Member-Only Content

Explore deeper insights with a wide range of premium content, including exclusive data, in-depth analysis and expert investment commentary.

DDR5 spot prices

Forecasts for Samsung

Electronics’ operating profit

May 23

May 30

Jun 6

Jun 13

Jun 20

2023

0

0

20

5.4

40

5.6

60

5.8

80

6.0

2024

2025

2026

2027

(Source: Morgan Stanley)

(Source: DRAMeXchange)

*Estimates from 2025 to 2027

*DDR5 16G 4800/5600 products

(Unit: dollars)

(Unit: trillion won)

66

6.6

5.5

6.0

Data Speaks

We offer real-time, data-driven insights on Korean companies and industries using alternative data such as trade, consumption, customs figures and news analytics.

Each article provides differentiated, data-based perspectives on the Korean market.

South Korea’s Export Statistics

Track Korea’s trade dynamics and key industries.

Use these insights to monitor sector trends, competitor activity, and apply them directly to your investment strategies and market outlooks.

K-Deals Newsletter

Receive weekly updates on major deals involving Korean companies and institutional investors

— such as M&As, investments, and asset sales—through our members-only newsletter.

October 15, 2025

$

-

Deals

Deals Spotlight News

SK Group will sell its entire 35% stake in Sinopec-SK Petrochemical, exiting the petrochemical sector after losses of over 1 trillion won since 2021 due to oversupply and weak demand.

The Wuhan-based plant, launched in 2013 with 3.3 trillion won, once generated 2 trillion won in cumulative profit but has seen profitability collapse as China rapidly expanded ethylene output.

The divestment aligns with SK’s shift to its “ABC strategy” of AI, batteries, and chips, with proceeds of about 819.3 billion won expected to fund AI data centers, semiconductor packaging, and energy systems.

SK Group’s decision highlights its shift from traditional industries to future growth engines, with attention now on how AI and semiconductor investments will pay off.

More to Read

Editor’s comment

- LG Chem to sell water filter business to Glenwood PE for $692 million

- Korea’s top cinema chains seek merger to counter box office slump

- LG Electronics breaks ground on $600 mn home appliance plant in India

SK Group to sell entire 35% stake in Chinese JV Sinopec-SK Petrochemical

Hello from Seoul!

Here’s what’s shaping the week.Samsung is doubling down on itself – powering about half of its upcoming Galaxy S26 phones with its own Exynos 2600 AP. After years of setbacks, it’s a bold play to bring its chip game back to the big league. Our coverage breaks down what’s fueling Samsung’s renewed confidence in chip design and foundry operations.

EDITOR’S NOTE

By Sookyung Seo

Hello, here are this week’s K-Deals updates.

About KED Global

The KED Global delivers trusted, high-impact journalism on the Korean economy and the Korean market for a global audience of economists, investors and business leaders.

Journalism of Global Standards

Editors from Reuters, Bloomberg and the Wall Street Journal bring you insight-driven reporting that goes beyond simple translation.

Private equity

Economy

Business & Politics

Korea-Focused Professional Content

Access curated, verified and premium economic and business intelligence – all in one place.

$

Spotlighting Korean Companies

We highlight the global growth and innovation of Korean companies, from advanced manufacturing to high technology.

Quick & Brief

Every Weekday

$

Korean Investors

Wednesdays

$

Newsletter for Busy Investors

Subscribe to Korean Investors and Quick & Brief for free and receive key updates on the Korean market every morning.

FAQ

How can I cancel my subscription?

What is the refund policy if I cancel immediately?

How can I contact KED Global Support?

Membership for

Global Investors and Leaders

Join today and start exploring the Korean economy

like never before.

Subscribe Now

The Korea Economic Daily Family

Support

Publisher & Managing Editor: Yoo Byungyun

Juvenile Protection Manager: Yun Dongbeom

Online newspaper registration No: 서울, 아53319

Date of registration: Oct 7, 2020

Business registration No: 796-87-01625

Contact: kedglobal@hankyung.com | +82-2-360-4319

Address: 14F The Korea Economic Daily Bldg., 463, Cheongpa-ro Jung-gu, Seoul, Korea 04505

Copyright© 2025 KED Global News Network . All Rights reserved

Unlimited access,

closer to the

Korean economy

Bringing Korea’s key insights and market trends to global investors and business leaders. Unlock new opportunities through in-depth analysis and premium content.

50% Off to Celebrate Our New Membership Launch

Get unlimited access to

KED Global articles for only $10

Monthly Plan

$10/mo

$20

You can cancel anytime

Billed at $10 per month for your first year, then $20 per month thereafter

50% off

58% off

Annual Plan

Billed once at $100 for your first year, then $200 per year thereafter

$240

$100/year

You can cancel anytime

Subscribe now

After the promotional period ends, your subscription will renew at the regular rate.

For details, please refer to the Terms of Service.

Exclusive Member Benefits

Priority Access to in-depth insights on the Korean economy

Unlimited access to all premium content

Professional Analysis and investment insights available exclusively to members

Members-only newsletter

Stay informed with K-Deals, our exclusive newsletter featuring:

Weekly updates on Korean corporate deals and investments

Korea’s Major Export Data

Gain valuable investment insights through trade and industry analysis.

Best Asset Managers Survey

Discover the latest results from our survey of top-performing asset managers, selected by Korean investors.

Discover Member-Only Content

Explore deeper insights with a wide range of premium content,

including exclusive data, in-depth analysis and expert investment commentary.

DDR5 spot prices

Forecasts for Samsung

Electronics’ operating profit

May 23

May 30

Jun 6

Jun 13

Jun 20

2023

0

0

20

5.4

40

5.6

60

5.8

80

6.0

2024

2025

2026

2027

(Source: Morgan Stanley)

(Source: DRAMeXchange)

*Estimates from 2025 to 2027

*DDR5 16G 4800/5600 products

(Unit: dollars)

(Unit: trillion won)

66

6.6

5.5

6.0

Data Speaks

We offer real-time, data-driven insights on Korean companies and industries using alternative data such as trade, consumption, customs figures and news analytics.

Each article provides differentiated, data-based perspectives on the Korean market.

South Korea’s Export Statistics

Track Korea’s trade dynamics and key industries.

Use these insights to monitor sector trends, competitor activity, and apply them directly to your investment strategies and market outlooks.

K-Deals Newsletter

Receive weekly updates on major deals involving Korean companies and institutional investors

— such as M&As, investments, and asset sales—through our members-only newsletter.

$

-

Deals

Deals Spotlight News

SK Group will sell its entire 35% stake in Sinopec-SK Petrochemical, exiting the petrochemical sector after losses of over 1 trillion won since 2021 due to oversupply and weak demand.

The Wuhan-based plant, launched in 2013 with 3.3 trillion won, once generated 2 trillion won in cumulative profit but has seen profitability collapse as China rapidly expanded ethylene output.

The divestment aligns with SK’s shift to its “ABC strategy” of AI, batteries, and chips, with proceeds of about 819.3 billion won expected to fund AI data centers, semiconductor packaging, and energy systems.

SK Group’s decision highlights its shift from traditional industries to future growth engines, with attention now on how AI and semiconductor investments will pay off.

More to Read

Editor’s comment

- LG Chem to sell water filter business to Glenwood PE for $692 million

- Korea’s top cinema chains seek merger to counter box office slump

- LG Electronics breaks ground on $600 mn home appliance plant in India

SK Group to sell entire 35% stake in Chinese JV Sinopec-SK Petrochemical

Hello from Seoul!

Here’s what’s shaping the week.Samsung is doubling down on itself – powering about half of its upcoming Galaxy S26 phones with its own Exynos 2600 AP. After years of setbacks, it’s a bold play to bring its chip game back to the big league. Our coverage breaks down what’s fueling Samsung’s renewed confidence in chip design and foundry operations.

EDITOR’S NOTE

By Sookyung Seo

Hello, here are this week’s K-Deals updates.

About KED Global

The KED Global delivers trusted, high-impact journalism on the Korean economy and the Korean market for a global audience of economists, investors and business leaders.

Journalism of Global Standards

Editors from Reuters, Bloomberg and the Wall Street Journal bring you insight-driven reporting that goes beyond simple translation.

Private equity

Economy

Business & Politics

Professional Insights on Korea

Access curated, verified and premium economic and business intelligence – all in one place.

$

Spotlighting Korean Companies

We highlight the global growth and innovation of Korean companies, from advanced manufacturing to high technology.

Quick & Brief

Every Weekday

$

Korean Investors

Wednesdays

$

Newsletter for Busy Investors

Subscribe to Korean Investors and Quick & Brief for free and receive key updates on the Korean market every morning.

FAQ

How can I cancel my subscription?

What is the refund policy if I cancel immediately?

How can I contact KED Global Support?

Membership for Global Investors and Leaders

Join today and start exploring the Korean economy like never before.

Subscribe Now

The Korea Economic Daily Family

Support

Publisher & Managing Editor: Yoo Byungyun

Juvenile Protection Manager: Yun Dongbeom

Online newspaper registration No: 서울, 아53319

Date of registration: Oct 7, 2020

Business registration No: 796-87-01625

Contact: kedglobal@hankyung.com | +82-2-360-4319

Address: 14F The Korea Economic Daily Bldg., 463, Cheongpa-ro Jung-gu, Seoul, Korea 04505

Copyright© 2025 KED Global News Network . All Rights reserved